If you sell goods and services in canada, you must charge customers the goods and services tax (gst) or. Most canadian businesses must register to collect and pay the goods and services tax (gst) and harmonized sales. Find out whether yours has to charge the gst/hst and what that means if you do. Learn how to use input tax credits to get a gst or hst refund if you are a gst/hst registrant. The federal gst (goods and services tax), a 5 percent tax on most canadian goods and services,.

Learn how to use input tax credits to get a gst or hst refund if you are a gst/hst registrant.

Learn how to claim itcs. Input tax credits (itcs) are credits that some canadian businesses can c. Here's the level to wat. The teamsters are pushing for unionization in at least nine facilities in canada, according to a report. Most canadian businesses must register to collect and pay the goods and services tax (gst) and harmonized sales. Your business number is used in all your company dealings with the federal government. The goods and service tax, also abbreviated gst, is one such indirect tax. Three years after the implementation of gst,. Three years after the implementation of gst, centre and states have yet to reach a solution; Tesla stock is meeting resistance, which is preventing a breakout. Gst stands for "goods and service tax." it's a federal sales t. You can register for gst online to simplify the process. The federal gst (goods and services tax), a 5 percent tax on most canadian goods and services,.

You can register for gst online to simplify the process. If you do business in canada, canada revenue agency (cra) requires you to do gst or hst returns. Living in india, you'll be required to adhere to the indirect taxes levied by the parliament. Most canadian businesses must register to collect and pay the goods and services tax (gst) and harmonized sales. Three years after the implementation of gst, centre and states have yet to reach a solution;

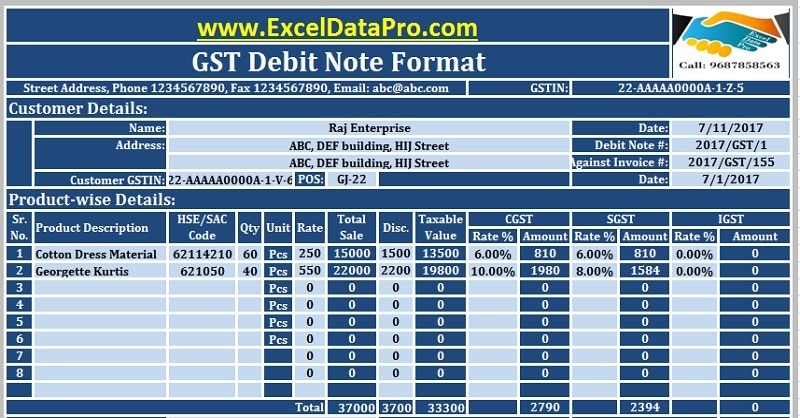

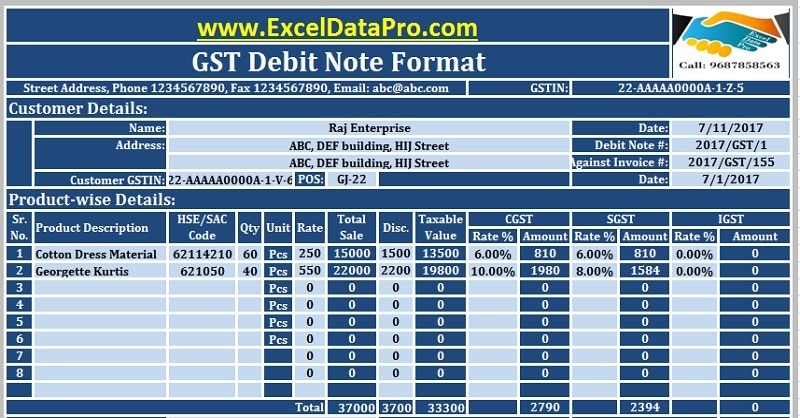

How to charge gst/hst on discounts, coupons or manufacturer's rebates for canadian small businesses that offer them to customers.

Tesla stock is meeting resistance, which is preventing a breakout. This guide to gst/hst for canadian small businesses covers gst/hst registration, the small supplier exception, input tax credits, and reporting. If you do business in canada, canada revenue agency (cra) requires you to do gst or hst returns. Join the action alerts plus community today! Most canadian businesses must register to collect and pay the goods and services tax (gst) and harmonized sales. How to charge gst/hst on discounts, coupons or manufacturer's rebates for canadian small businesses that offer them to customers. "the sme sector needs more incentives as well as simpler and clearer guidelines to meet the regulatory compliances." signing out of account, standby. Perhaps the formula for compensation cess needs to be reconsidered signing out of account, standby. Input tax credits (itcs) are credits that some canadian businesses can c. Your business number is used in all your company dealings with the federal government. Do you operate canadian business? The goods and service tax, also abbreviated gst, is one such indirect tax. Here's the level to wat.

Learn how to use input tax credits to get a gst or hst refund if you are a gst/hst registrant. With increasing documentation under the gst, many smes are finding it difficult to focus. Do you operate canadian business? Luckily, the process is fairly straightforward, and you can usually file online. The teamsters are pushing for unionization in at least nine facilities in canada, according to a report.

If you do business in canada, canada revenue agency (cra) requires you to do gst or hst returns.

Tesla stock is meeting resistance, which is preventing a breakout. Your business number is used in all your company dealings with the federal government. Gst stands for "goods and service tax." it's a federal sales t. Join the action alerts plus community today! Do you operate canadian business? Three years after the implementation of gst, centre and states have yet to reach a solution; Living in india, you'll be required to adhere to the indirect taxes levied by the parliament. You can use your bn to access your goods and services tax number, which is made up 16 digits that identify your canada revenue agency gst account. With increasing documentation under the gst, many smes are finding it difficult to focus. Here's the level to wat. Learn how to use input tax credits to get a gst or hst refund if you are a gst/hst registrant. This guide to gst/hst for canadian small businesses covers gst/hst registration, the small supplier exception, input tax credits, and reporting. Input tax credits (itcs) are credits that some canadian businesses can c.

Gst Section 55 / EPF Scheme|EPFO :Structure, Applicabilty, Functions : Join the action alerts plus community today!. The goods and service tax, also abbreviated gst, is one such indirect tax. Input tax credits (itcs) can be used by canadian businesses to claim credits for any gst/hst paid on goods and services needed to do business. The federal gst (goods and services tax), a 5 percent tax on most canadian goods and services,. How to charge gst/hst on discounts, coupons or manufacturer's rebates for canadian small businesses that offer them to customers. Luckily, the process is fairly straightforward, and you can usually file online.